This investment policy is based on the premise that every asset in a market has to be owned by a participant in the market at every point in time and no participant will ever rationally own an asset which they believe to be ...a bad deal... . Thus, if a participant thinks an asset is undervalued at its current price, then they will buy it and, if a participant thinks an asset is overvalued at its current price, then they will sell it. Since a transaction requires a buyer and seller, this leads to assets having a price which is the aggregate accepted price from all of the participants in the market, where prices will efficiently adjust to meet the supply and demand from the opinions of participants. Thus, the current price of an asset should only rationally change when unexpected new future information is introduced into the market, such that the aggregate accepted price from all of the participants in the market reacts to the unexpected new future information.

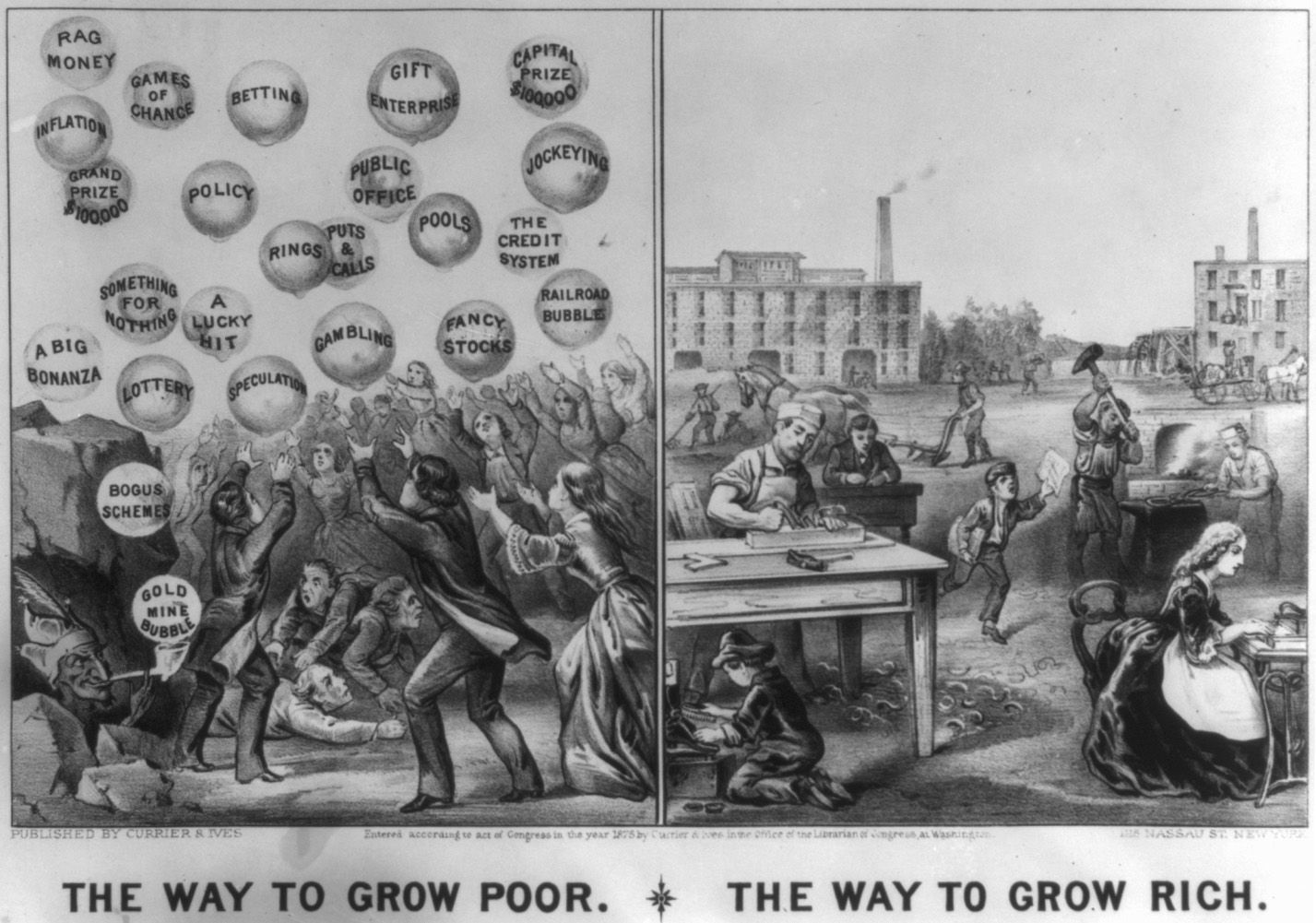

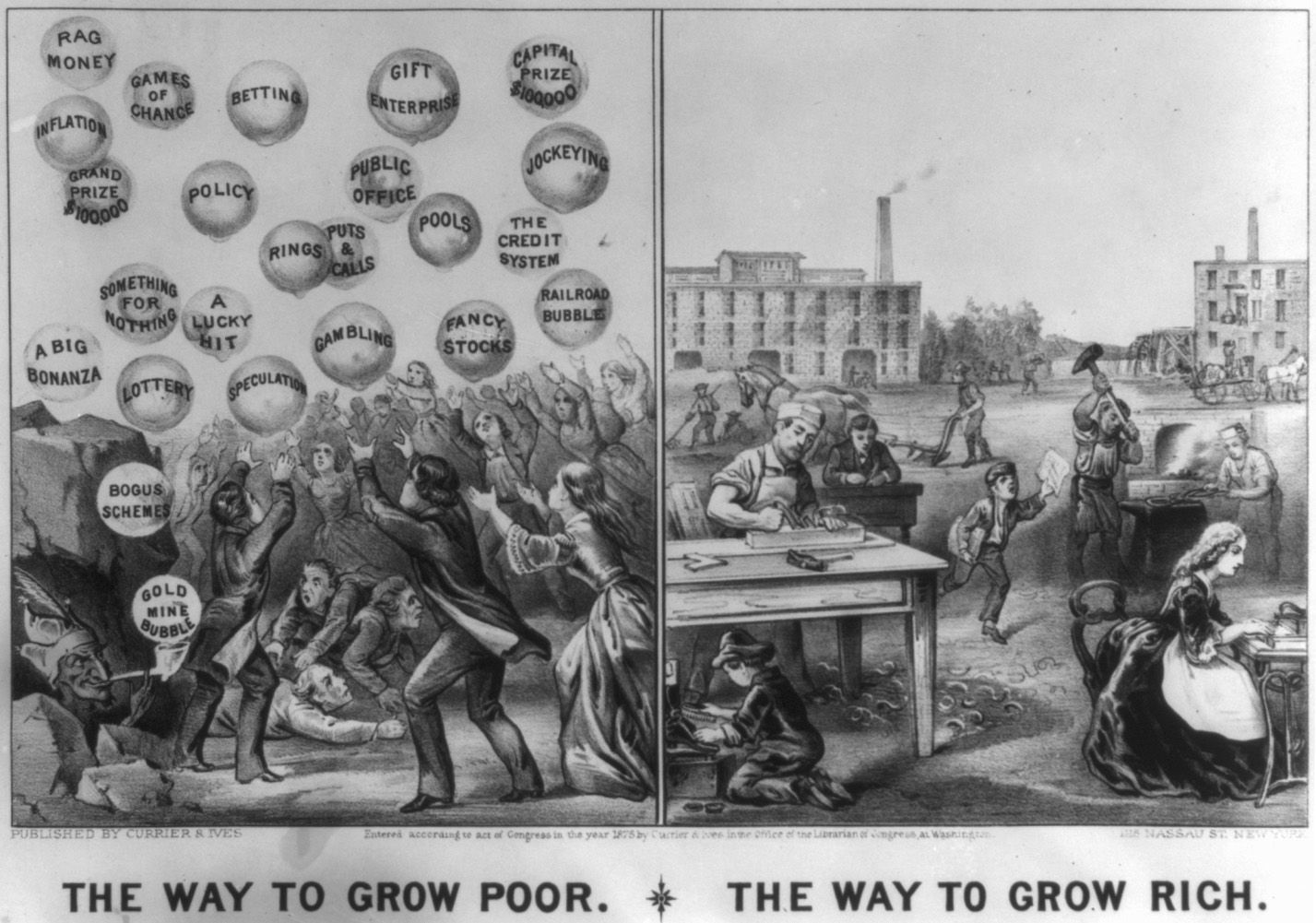

So, when an individual participant buys or sells a particular asset without new unexpected information, they are claiming that the current price is incorrect and, essentially, they are betting against the aggregate accepted price from all of the participants in the market. Is there any reason to believe that this specific individual participant, who has the same information as all of the other participants in the market, is correct? Well, based on the wisdom of crowds, it can be asserted that the collection of information in groups results in decisions which are often better than could have been made by any individual participant of the group, as none of the individual participants have all of the information, but the group as a whole must have all of the information. Maybe the individual participant is truly an extreme outlier with actual skill (as is the case in sports with Cristiano Ronaldo, Rafael Nadal, and Michael Jordan), but then it would only be rational for them to demand a high fee which would likely negate any slight advantage provided by their skill, while it should also be kept in mind that they are competing against other participants who are equally skilled (such as rivals like Lionel Messi, Roger Federer, and Kobe Bryant). In the best case for the individual participant, the chances are that the outcome will be determined by luck based on whether unexpected new future information, which the participants do not know but can only anticipate, happens to be positive or negative (to be clear, it should be seen that even the expectation of new future information is already contained within the current price). Markets are competitive and most people do not have access to Renaissance Technologies.

...

The initial substance to the idea of "diversification across time" was put forward by Ayres and Nalebuff in their book called "Lifecycle Investing: A New, Safe, And Audacious Way To Improve The Performance Of Your Retirement Portfolio" and article called "Diversification Across Time". Considering a mortgage, ... .

Essentially, the argument of using leverage is summarized as spreading market exposure move evenly across time. This occurs because young people invest too little of their expected lifetime earnings in equities when their time horizon is most appropriate for the simple reason that they do not have the capital to invest. The proposed solution is to borrow money through leverage to increase their exposure to equities when the investor is young and reduce this exposure to equities as the investor gets older. It should be acknowledged that this reduction in exposure to equities is only on a relative basis and not in the actual amount invested which, by employing leverage, is more consistent throughout the life of the investor. In a sense, this assumes that future income can be seen as a bond, although this stability can vary depending on the industry of employment, and requires that the expected return of equities is greater than the expected cost of borrowing.

This argument for "temporal diversification" is ultimately correct if the most optimal portfolio is the ultimate goal, where either risk can be reduced for the same expected return or risk can be maintained for a higher expected return (or a combination of these outlooks). However, there is still the question of whether the average investor (likely someone who does not have a concrete savings plan, cannot even use market capitalization weighted index funds, and enjoys speculating with individual securities) would be able to make this strategy a success, because it would be very difficult to recover if the investor ...mess up... the implementation. Subsequently, for a conservative conclusion, this strategy should be avoided by most (if not all) investors.

Graph of using the strategy from the book.It would be a rational goal for anyone to get to a position in which they are able to decide what to do with their time without restrictions. This is often misinterpreted as retirement (or maybe what retirement should actually be is misinterpreted), but there is no requirement for this to be the case. Instead, it is being able to choose what work to do and what work to avoid, as there is no burden of financial consequences when issuing a mandate. In many cases, this even leads to greater financial compensation, as there is freedom to explore without needing to be cautious and with the de-prioritization of income (although building a large portfolio for no other reason is not particularly rational).

From another perspective and thinking of it as an optimization problem, the focus should be about getting the maximum happiness per unit spent. In many cases, this will lead to the conclusion that contributing towards investments to build a portfolio which will eventually be able to control time is the most rational goal to pursue, as there are few luxuries above fundamental needs which are more valuable than time. To emphasize, this is not always the case and will be dependent on the situation - it is a simplified generalization. In addition, the rate at which these contributions are made will vary depending on the situation. Regardless, conscious thought should be applied as to determine the most optimal strategy which will lead to getting the maximum happiness per unit spent. Comparing any two situations in which someone either has control of their time or does not have control of their time, the case where this person has control of their time will almost always have higher happiness - it is simply the process of getting to this position which is variable.

For many people, their work is placed on a pedestal and used as their identity in some form. There is a high likelihood that they have been conditioned to think this way based on their experiences and perceptions of future possibilities. For example, if someone never sees an alternative from their everyday life, they will almost certainly accept that life, either knowingly or unknowingly, as who they are, as they cannot see any other possibilities for whom they could be. However, there could be so many more future possibilities once the available options are actually considered. Unfortunately, most people do not consider the available options, as they either dismiss them too eagerly or do not know that they exist.

With reasonable and modest expectations, it is possible for the vast majority of people to be able to reach this position. Obviously, there are factors which help, such as starting early, living frugally, maintaining health, changing habits, understanding research, acknowledging realities, and maximizing income. The ultimate personal goal of this policy is to be able to decide what to do with time without restrictions, however the rate at which this goal is achieved depends on personal circumstances.

Avoiding active management through a low-cost, globally-diversified, value-weighted, and passive fund will get almost everyone anywhere they need to be. In addition, routinely investing a portion of income without further considerations will also get almost everyone anywhere they need to be. There are slight optimizations which could be incorporated through risk factors and leverage, but these optimizations often come with the requirements of pursing further knowledge and sacrificing time. Regardless, the most influential determinant in deciding a successful outcome will be the behaviour of an investor, so maintaining a simple plan and staying the course are always the most important considerations. There is a lot of life to live between now and retirement.